The key to reducing your debt is to reduce your expenses. It doesn’t matter how much you earn. What matters is how much you keep. By trimming your expenses, you’ll get to keep more, and debt will become a thing of the past. Let’s look at 4 ways to reduce your expenses. They may not be easy… but they work. Tough times call for tough measures.

1. Cut your expenses

Study your bills and trim out all the ‘fat’. Have magazine subscriptions? Cancel them. You’ll survive without magazines. Have subscriptions to cable channels that you never use? Cancel them. You can read the 7 Common Financial Mistakes to Avoid in the 2022 blog post here.

If you study your finances with a fine-toothed comb, you’ll be able to find many ways to cut unnecessary expenses. Keep a notebook where you write down all your bills and expenses. You’ll see what really matters and what doesn’t. Remove what doesn’t. Having an easy-to-use finance bundle would be a great start. You will have 20 printable to keep your finances intact.

The finance Planner Bundle includes:

1. Monthly Budget

2. Yearly Savings Planner

3. Monthly Savings Planner

4. Weekly Grocery List

5. Weekly Grocery Budget

6. 52 Weeks Savings Challenge

7. Monthly Income Tracker

8. Monthly Expense Tracker

9. Credit Card Payment Tracker

10. Student Loan Repayment Tracker

11. Monthly Bill Tracker

12. Password Tracker

13. Subscription Tracker

14. Festive Gift Tracker

15. Car Loan Repayment Tracker

16. Donation Tracker

17. Investment Planner

18. Financial Goal Planner

19. Yearly Financial Tracker

20. Snowball Tracker

2. Pay more than the minimum sum

You’ll never get out of debt if all you pay is the minimum sum on the credit cards you own. You’re paying every month for the interest the banks are levying on you. You MUST make a dent in the interest.

The best way to do this is to pay slightly more than the interest. Pick the credit card with the highest interest rate on your outstanding balance and pay more on that card than the minimum. If you have several cards that have an outstanding balance, pay the minimum on those and work on paying more for just that one card.

Over time, you’d have repaid all the debt on that card. Now, use the amount that you were usually paying on that to pay over and above the minimum for the next card.

When the second card is done, move on to the third and the ones after that. This is the fastest way to pay up your credit card bills.

Adhere to the 4 tips above and not only will you reduce your expenses, but you’ll also reduce your debt. Depending on how much you owe, it may take you a few months or even several years. That’s just how it is.

You’ll need to keep your nose to the grindstone and grimly make progress. The good news is that by the time you’re done, you’ll have more financial discipline and awareness than you ever had before. A Debt Snowball Calculator like this one would be great to reduce your debts one by one.

3. Cook at home

This long-forgotten art has many financial and health benefits. These days, most people are too busy to prepare their own meals at home. They always purchase food from outside and it has become the norm.

Not only is store-bought food unhealthier, but in the long run, it’s costly too. Upon initial glance, it may seem like it’s more cost-effective to purchase your meals from stores. However, if you did the math, you’d realize that you’ll be saving yourself hundreds of dollars just by cooking your own meals and eating at home.

The top bodybuilders and fitness athletes on the planet prepare their meals at home. It’s that good for your health. You’ll lose weight and be less likely to get diseases like diabetes, high cholesterol, hypertension, and so on.

A medical problem can sink you up to your eyeballs in debt. It’s best to cook your own healthy meals. Cook once on Sunday and pack all your meals and store them in the refrigerator for the week. It’s as easy as that. If you like an easy-to-cook receipt book, please get this one HERE FOR FREE!

4. Stay home

Just when you thought eating at home was going to cramp your style, now you’re being asked to stay home too. Yes, this is one of the best things that you can do. If you’re deep in debt, staying home will help to curb your frivolous expenses.

You’ll be less likely to buy items you don’t need, or fritter away a few dollars at the bar, or spend money on gas, etc. Go home after work, eat your home-cooked meal and relax with a book or watch TV.

It may be boring, but you have no choice. Reducing debt will require extreme measures until you have a grip on things. To start with try challenging yourself with these amazing savings challenges.

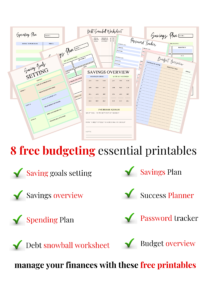

For you to start this journey I have created free 8 budgeting printables. You can download them here!

Disclaimer: This website is written by a regular human. I am not a Financial Professional. Please get professional advice for your specific financial needs.