Millions of people around the world face financial problems because they do not have good money habits. These are usually not taught in school. While we learn about history and geography (which most of us will never use), personal finance is highly important but is not taught. Because of this, many people never realize just how dangerous poor spending habits can become. Financial problems have led to countless people going through bankruptcy, divorces, suicides, etc. Below you’ll find 7 common financial mistakes to avoid in 2022. Avoid them at all costs.

1. Overspending

This is probably the biggest one of the lot. There’s a saying – cut one’s coat according to one’s cloth. It basically means that you should live within your means.

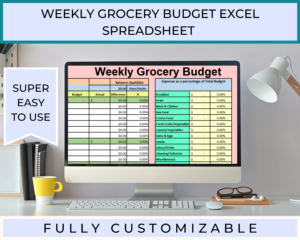

We live in times when people want instant gratification. They buy things on credit and before they know it, bills start piling up and they start scrambling and panicking because they’re in debt. Having a weekly grocery budget like this one can be very useful to keep a track of your grocery expenses.

2. Buying based on emotions

Millions of people purchase items just because of how they’re feeling at that moment in time. If they see advertisements for the latest and greatest car, they quickly put a down payment on it just to feel like they’re cool and hip.

That’s all good if one can afford the car. However, if you’re overstretching yourself, the upkeep of the car could become your downfall. Having a budget is always good and especially an income and expense tracker like this one. So you can always track your income and expenses.

3. Using credit cards for everything

More people go into debt because of credit cards than any other thing on the planet. The banks know this, and they love it. Banks will act like your best friend, offering you perks and cards, making you feel like you’re a baller.

People often get as many cards as they can and spend without worry. When the balance starts snowballing, and the interest payments skyrocket, then they realize just how merciless the banks actually are. It’s best to be wise early. You can use a credit card payment tracker to keep your card payments in order.

4. Falling for ‘get rich quick’ schemes

Anything that sounds too good to be true usually is. Thousands of people get conned on a daily basis to buy financial plans they don’t need or get tempted to invest in things they’re clueless about.

The salesperson’s pitch is emotional and enticing. They invest in some supposedly profitable plot of land hoping to reap returns, only to discover that their investment is worthless and now their money is either gone or they’re stuck with a burden they don’t need.

5. Failing to plan for retirement

Most of us live to a ripe old age these days, and yet so many people fail to plan for retirement. You must plan to build a nest egg for the future (factoring inflation in your planning) so that you can retire comfortably. Having to work when you’re a senior can be highly depressing and tiring.

More and more seniors are entering the workforce nowadays as they struggle to keep up with their bills. To avoid being one of them, planning early is crucial. Be more organized and use many resources as possible for you to maintain your financial position. Even a simple bundle of printables like this one would be very useful.

6. Not earning more

It’s easy to find one job and stick to it for the rest of your life. Millions of people do this and stagnate. Their salary doesn’t really increase that much over time and they’re always living from paycheck to paycheck.

One of the best ways to improve your finances is to make yourself more valuable to the marketplace. This will allow you to command a higher salary and have more money. If you increase your income and maintain your current expenses, you’ll have more money to save.

7. Not saving

This is one of the most important habits in life. A common mistake people make is not saving any money. They try to save what’s left after spending, and often they find that there’s nothing left to save. Instead, you should save FIRST and then spend what’s left.

Always save a portion of all that you earn. Over time, you’ll have a sum of money that you can rely on if any problems arise. Just the knowledge that you have some money on hand will give you more confidence.

These 7 mistakes mentioned above can lead one to financial ruin if they’re not addressed. Now that you’re aware of these mistakes, check and see if any exist in your life and remedy them quickly. It takes a long time to recover from a financial mess. So, prevention is better than cure.

Having read the above seven common mistakes people make, you should know how to overcome financial misfortune due to one or more of the above.

One cardinal rule is that you cannot spend what you do not have; hence keeping the use of credit cards to an absolute minimum is vital. It is an absolute necessity to budget your income and expenses as this will give you an idea as to how well you are trending in your daily and monthly expenses. When budgeting, take note of the above mistakes and plan your spending according to the income you derive. Here are some tips.

You can challenge yourself this new year to start saving with these amazing saving challenges. You can start even as small as $2 a day.

These are 7 common financial mistakes to avoid in 2022. Avoid them at all costs in 2022 and make this new year the best year ever.

Disclaimer: This blog post contains affiliate links to products and services I am passionate about. Purchasing via these links won’t cost you any extra but it will help me enormously.

This website is written by a regular human. I am not a Financial Professional. Please get professional advice for your specific financial needs.