Financial stress is one of the most common types of stress that affects millions. The biggest culprit are the banks who make it easy to get credit cards. They know that most people lack discipline and would rather spend now for instant gratification rather than save. The end result is huge credit card bills that never seem to end because of the snowballing interest rates and people are trapped into paying the banks for ages before they can make a dent in their balance. In this article, we’ll look at a few steps that you can take to put an end to the financial stress that’s weighing you down. So below are the 8 steps you can take to reduce financial stress.

1. Analyze your finances

This is the most important step. Most people bury their heads in the sand and only pay off the minimum sum on their cards because they’re fearful of seeing just how much they owe in total. It can be overwhelming and scary, but it’s a NECESSITY.

Add up the balance from all your cards and loans. You’ll now have a number which is a rough estimate as to how much you need to pay back.

This is a start. Knowing where you are will remove half the stress and worries that you have. It may seem scary but rest assured that you can end the problem. You can try a debt snowball calculator to pay off debts one by one.

2. Self-reflect

This is crucial. Analyze your spending habits. Do you spend off all the money you have? Are you comfortable with money?

If you grew up in a home where finances were always tight, you’ll probably end up being a spendthrift and get rid of all your money so that you can still feel the same way.

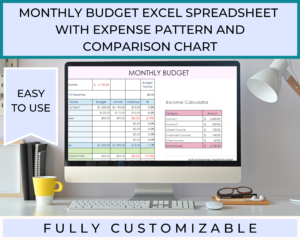

It may seem strange, but we’re creatures of habit and we’ll always act according to our financial thermostat. Spend time in deep thought and try to figure out why your finances are the way they are. Aim to fix the underlying problem. The best way is to have a budget in place – start with an easy-to-use monthly budget and from there you can go for quarterly budgeting and yearly budgeting.

3. Increase your income

Get a second job or a part-time job. The more you increase your income, the faster you can pay off your bills and debt.

4. Don’t buy into the hype

Forget the media’s portrayal of success. Avoid unnecessary spending on ostentatious items. A $30 watch and a $4,000 one will still tell the same time. The latter one will just put you in debt for ages. When you’re financially independent, you can indulge… but don’t go into debt just to appear rich. You can have an income and expense tracker in place to avoid these unnecessary expenses – like this one.

5. Simplify and restructure

Simplify your finances as much as you can. Cancel any unnecessary recurring bills such as magazine subscriptions, etc. Cut up most of your credit cards and just keep 1 or 2.

Call up the banks and see if they’ll help you to restructure your outstanding loans. You might be able to negotiate for lower interest rates.

Pay up the bill with the highest interest rate and pay the minimum on the rest. Focus on clearing that one bill… and when you’re done with it, take the amount that you normally pay for the bill that was just settled and use it to pay the next one, over and above the minimum you were already paying this far.

From there you’ll clear the next bill and the next until you’re all done. This is the fastest way to clear off all credit card debt. It will take a while, but you’ll get there. Something useful for you would be a finance bundle like this one. There are so many useful simple Finance Planner Printables are included in this bundle.

The finance Planner Bundle includes:

1. Monthly Budget

2. Yearly Savings Planner

3. Monthly Savings Planner

4. Weekly Grocery List

5. Weekly Grocery Budget

6. 52 Weeks Savings Challenge

7. Monthly Income Tracker

8. Monthly Expense Tracker

9. Credit Card Payment Tracker

10. Student Loan Repayment Tracker

11. Monthly Bill Tracker

12. Password Tracker

13. Subscription Tracker

14. Festive Gift Tracker

15. Car Loan Repayment Tracker

16. Donation Tracker

17. Investment Planner

18. Financial Goal Planner

19. Yearly Financial Tracker

20. Snowball Tracker

6. Watch your finances like a hawk

Keep a close eye on your spending habits. Do not allow new expenses to creep in. Do not make new purchases the moment you have some room to breathe in your expenses. You can read my blog about 7 Common Financial Mistakes to Avoid in 2020 here.

7. Crush all debt

Your goal should be to clear ALL credit card debt, credit lines, etc. Focus all your efforts on this and you should trim your expenses until you’re done. You may even need to go on a financial ‘fast’ for 2 or 3 years just to accomplish this goal.

It will be tough… but when you’re done, you’ll feel an immense sense of relief and freedom. Not only will you be wiser with your finances, but you’d have developed financial

self-discipline. This is priceless. Save, save and save. Here are some savings challenges.

8. Save a portion of your earnings

Money gurus and financial books will usually advice you to save 10 percent. However, when you’re paying off your debts, even 10 percent may seem like a lot. There’s no need to panic.

Save just $10. Here’s the secret – it’s not how much you save that matters. It’s the act of saving.

Just putting aside $10 or $20 every month, will give you confidence that there’s a little bit of money there for you. You’ll have a feeling that there’s ‘excess’, which is different from always being short and having too much month at the end of the money.

Approach your finances is a slow and steady manner and don’t be emotional about it. Financial stress can be avoided by clearing your debts and trying your best to increase your income.

Time is your greatest ally. There’s no rush. Just stay the course. Try these 8 steps you can take to reduce financial stress. I am positive you can do it.

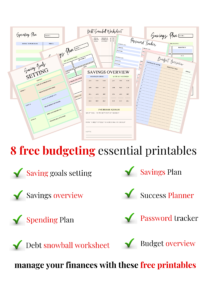

Here are some free printable for you! Start budgeting with these super-useful budgeting printables!

Disclaimer: This blog post contains affiliate links to products and services I am passionate about. Purchasing via these links won’t cost you any extra but it will help me enormously.

This website is written by a regular human. I am not a Financial Professional. Please get professional advice for your specific financial needs.